Money management for teens is probably the most important life skill you can teach your kids before they are sent out into the world. It comes right after reading, writing and arithmetic. An inability to control money or ignorance about how it works will spell misery for an entire lifetime.

Here are some basic points you want your teen to understand before they head out into the world.

- Interest is only good if someone is paying it to you. Don’t go into debt. Explain to them how interest works so they’re not out searching for how to make 10000 fast every time they need it. If you buy a rent-to-own sofa you pay only $499 for the sofa, but you also pay interest. The interest is not a percentage of the total. It’s a percentage of this months total. So month one, you pay 15% of $499. Month two you pay 15% of $480. Month three you pay 15% of $465. And so on for the entire 36 months. You end up paying for the sofa two or three times over. Interest works this way for houses, credit cards, cars, home equity loans, and any other debt.

- Don’t spend money you don’t have. If you don’t have enough money to go out for pizza, then you don’t go out for pizza. Simple.

- If you want enough money to go out for pizza, but don’t have it now, get a better job, learn more skills, get an education. Make yourself worth the big paycheck you think you deserve.

- Money is just numbers in a computer, but that doesn’t mean it’s not real. You can’t use a debit card or write checks indefinitely without the money running out. The check is tied to the bank account which is tied to money. (You wouldn’t believe how many young people don’t know that in order to write a check or use a debit card you are supposed to have money in the bank.)

- Pay yourself first. Before Uncle Sam even. Once your kids get a job, have them open a savings account. Don’t let them touch that money. Insist that they are saving it for college or their first house or a car or some other major purchase. Teach kids about the power of investments like a 401k. If you don’t know, get educated on it, you need to know this. This is where other people pay you money for allowing them to use yours. You’re the bank so to speak and it pays off in the long term and it’s tax deferred, which means your money grows without Uncle Sam touching it.

- Teach them the definitions of Capitalism, Socialism, Communism, and Fascism. Teach them how production is tied to incentive. It’s easy. Give them a chore list for a few weeks and nag and bug them to get it done, then institute a pay-per-chore system and leave them alone. After a few weeks discuss whether incentives make a difference in performance. Discuss which economic system would naturally show the greatest prosperity and progress.

- Teach them that they are masters of their money and not the other way around. Even on small incomes you can control your money, never go into debt, and never wonder how you’ll pay the bills. You must decide where the money goes and not be driven by the bills.

Library List

Here are some books on money that I recommend for teens:

- The Richest Man in Babylon by George S. Classon. A classic, it teaches about mastering money, becoming rich, and using your riches to bless others.

- Rich Dad Poor Dad for Teens by Robert Kiyosaki. Teaches how to use money to make money. Essential principles to being financially free and enabling yourself to do something in the world besides going to a job every day.

- The Stock Market by Robin R. Young. Written for young people.

- Financial Peace by Dave Ramsey (and anything else by Dave Ramsey)

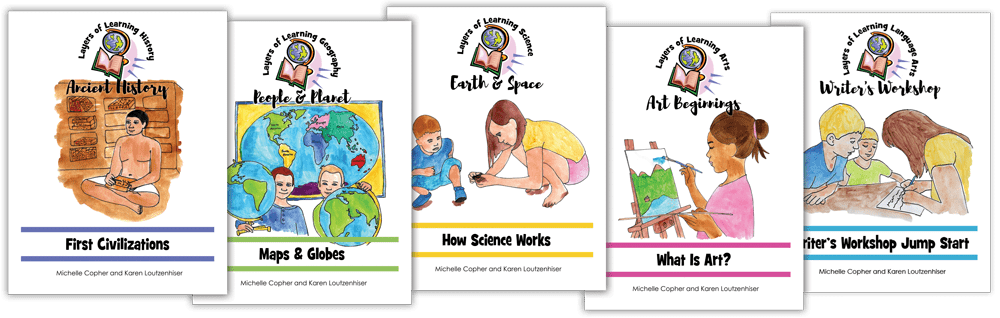

Get a Free Unit

Choose between the first unit in each Layers of Learning subject to try for free when you sign up for the newsletter.

We never spam and you can cancel your subscription at any time.

Great resources!

This is just great to read! Thank you for your passion about helping kids with financial skills. When I was younger, I didn’t have anyone to teach me financial stuff. The book that helped me was, Rich Dad Poor Dad. This is also a good site: http://www.Preparemykid.com